The definition of a Turnaround is a structured effort to restore a struggling company to financial health.

While the definition sounds straightforward, the real work goes beyond the restoration of balance sheets, profit-and-loss or positive cash flows. Every business has its own unique idiosyncrasies, internal politics and stakeholder pressures — and these can often define how a turnaround unfolds and whether it will be successful.

That’s where experienced advisors play a crucial role: combining financial insight with an understanding of people, process and practical realities.

Objective

The goal of any turnaround is simple — to keep moving forward.

As Rocky Balboa famously said:

“Life is not about how hard you can hit. It’s about how hard you can get hit and keep moving forward.”

That same principle applies in business recovery. The path to stability is rarely smooth, but progress comes from persistence, adaptability and a clear focus on outcomes despite what obstacles are placed in front of you.

Execution

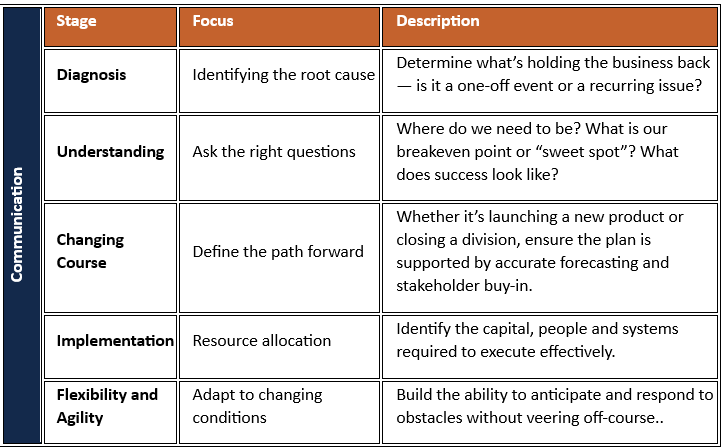

A successful turnaround typically moves through a series of key stages.

At every point, communication remains the foundation of success.

Competing Resources

Every turnaround face will face resource constraints and like the Project Management Triangle these are usually time, scope and cost.

Success depends on managing these competing factors and understanding that improving one often requires trade-offs with another.

Stakeholders play an important role in agreeing priorities and their needs will likely differ.

Balancing these needs requires experience, diplomacy, and clear communication — qualities that seasoned turnaround professionals bring to the table.

While technology can enhance analysis and forecasting, the judgment and empathy needed to lead a successful turnaround remains firmly a human skill.