As we close out 2024, it’s time to reflect on the trends and challenges shaping the insolvency and restructuring landscape, and what they signify for the year ahead. This year has brought heightened activity across our industry, underpinned by sustained economic pressures and evolving market dynamics.

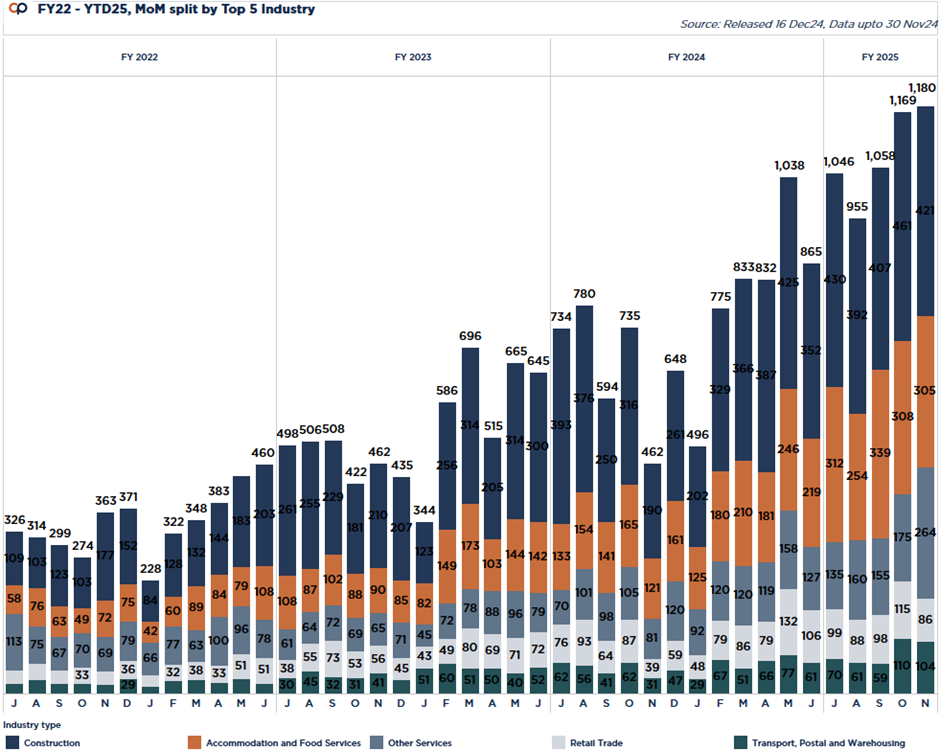

The numbers tell the story. Insolvency appointments have reached record highs, with over 40,000 cases since FY22, a trend largely driven by the construction industry, which alone has seen approximately 10,000 insolvencies. For nearly two years, this sector has remained under severe pressure, with no signs of easing into 2025.

Interestingly, the accommodation and food services industry has emerged as the second-most affected, with insolvency appointments climbing steadily from 125 in January to over 308 in October 2024. The sustained growth in this sector’s insolvencies is a stark reminder of the vulnerabilities that persist amid cost-of-living pressures and shifting consumer behavior.

On a broader scale, the AICD Director Sentiment Index revealed a concerning decline in confidence, dropping from -19.6 to -33.6 in the second half of 2024. Alarmingly, 46% of directors believe a recession is likely within the next year. These figures, coupled with persistent inflation and high interest rates, underscore the fragility of the current economic environment.

Regional and Industry Insights

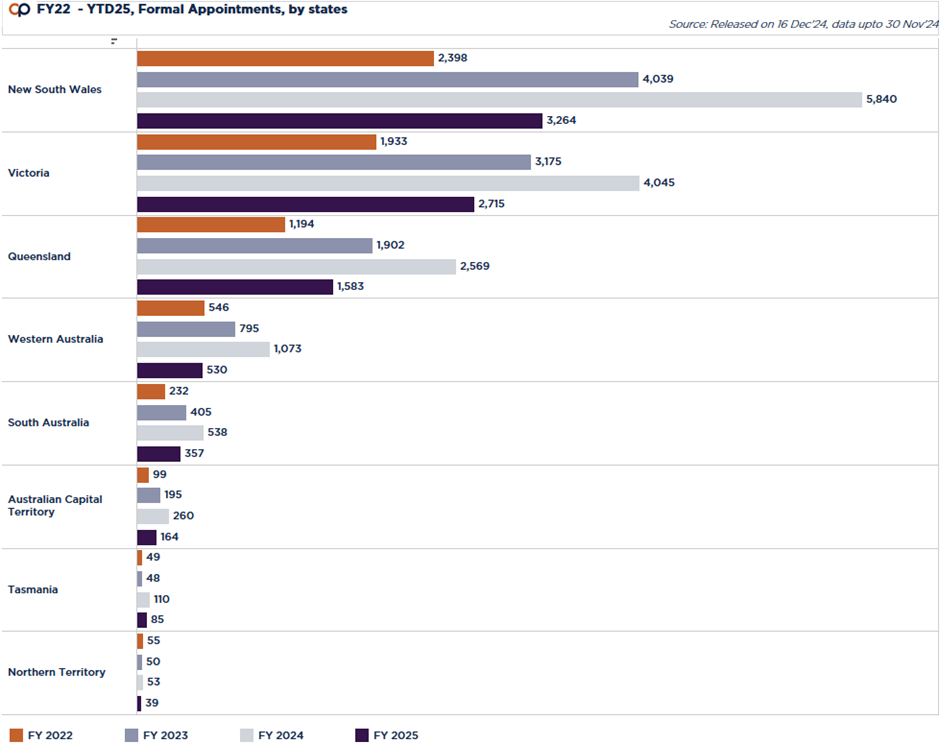

Across Australia, insolvency trends reveal significant regional dynamics and shifts in appointment types. New South Wales continues to lead in monthly insolvency numbers, although it appears the peak may now be behind us.

In contrast, Victoria is witnessing an upward trend in insolvency appointments, coupled with a strikingly low confidence level among directors in their state government’s business understanding, with only 23% approval.

Queensland, meanwhile, has seen a consistent rise in insolvencies, alongside the lowest national trust in government (16%), though recent leadership changes provide a glimmer of hope for improved sentiment in 2025.

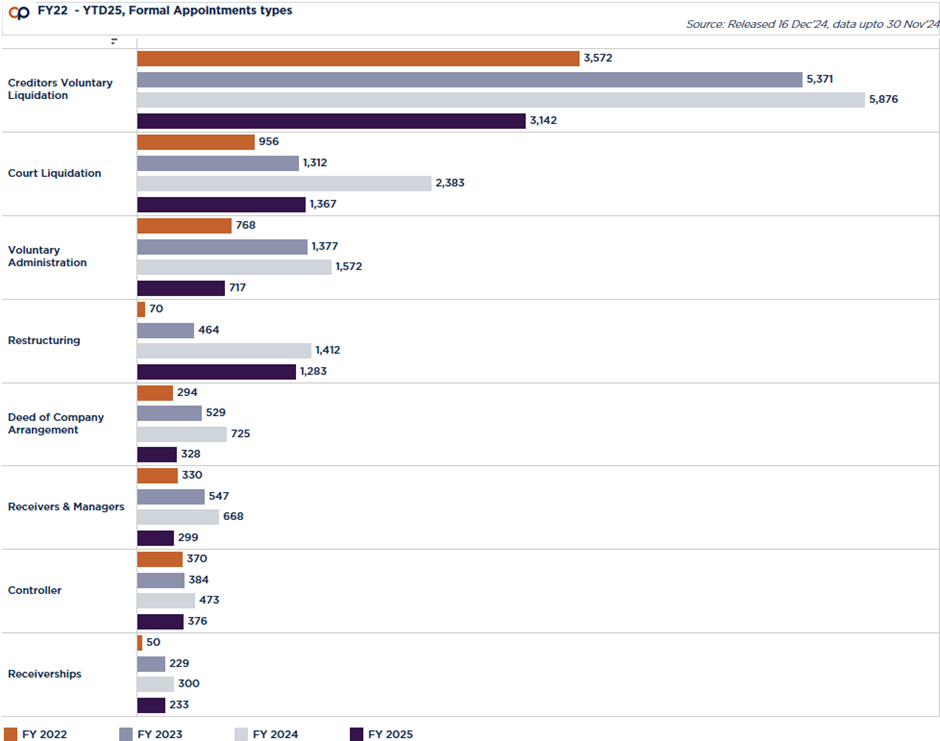

Across all states, creditors’ voluntary liquidations (CVLs) remain the dominant form of insolvency, with 3,142 (YTD25) appointments, while small business restructuring (SBR) continues to grow as a favoured option for managing tax-related liabilities. However, increasing scrutiny from the ATO, particularly on restructures involving director loans, presents a challenging landscape for businesses utilizing this approach.

Notably, while voluntary administration appointments have declined to 717 (YTD25), the rise in court liquidations 1,367 (YTD25) highlights stronger creditor actions and intensified recovery efforts by the ATO, reflecting a shifting focus in insolvency dynamics.

Looking Ahead to 2025

As I reflect on these trends, it’s clear that 2025 will present both challenges and opportunities.

- Economic Adjustments: While we expect interest rate cuts in the first quarter—potentially up to two more by year-end—their positive effects will only start materializing in the latter half of 2025.

- Consumer Impacts: Sustained cost-of-living pressures and prolonged high interest rates are expected to hit consumer spending harder, with ripple effects likely to affect the retail sector.

- Emerging Appointments: We anticipate an increase in controller and receivership appointments, driven by tightening non-bank funding and the resolution of hibernating distressed loans.

- Unemployment and Bankruptcy: Rising unemployment could exacerbate personal financial pressures, pushing bankruptcy appointments higher—a trend already in motion.

- The impact of the US Election on the world economy.

Despite the economic headwinds, our industry has proven resilient. Over the past 12 months, we have worked alongside businesses, creditors, and stakeholders to navigate a high-volume environment, delivering solutions to mitigate risk and unlock value.

As I look forward to 2025, I see a year of both complexity and opportunity. The continued high levels of insolvency appointments suggest that our services will remain critical in supporting businesses during these turbulent times. However, with diligence and collaboration, we can help shape outcomes that preserve value and position stakeholders for recovery.

Thank you to our clients, partners, and team for your trust and partnership throughout 2024. Here’s to a successful 2025, navigating the challenges together and emerging stronger.